Welcome to our guide on the benefits of using ERP accounting software for your business! Running a successful business requires efficient financial management, and implementing the right tools can make all the difference. ERP accounting software helps streamline processes, improve accuracy, and provide valuable insights for decision-making. Whether you are a small start-up or a large corporation, utilizing ERP software can give you a competitive edge in today’s fast-paced business world.

Overview of ERP Accounting Software

ERP Accounting Software is a comprehensive tool that integrates various financial and operational processes of a business into one centralized system. This software allows companies to manage their accounts, track transactions, generate financial reports, and streamline their overall accounting operations efficiently. In simple terms, ERP Accounting Software automates and simplifies the accounting processes for businesses, ultimately helping them to make informed financial decisions and improve their overall productivity.

One of the key features of ERP Accounting Software is its ability to provide real-time financial data and insights to businesses. This means that companies can access up-to-date information about their financial status, cash flow, expenses, and revenue anytime, anywhere. This real-time visibility into financial data enables businesses to make timely decisions, identify potential issues, and take corrective actions promptly.

Another important aspect of ERP Accounting Software is its scalability and flexibility. Whether a business is small, medium, or large, ERP Accounting Software can be tailored to meet the specific needs and requirements of the organization. From basic accounting functionalities like invoicing and payroll to more advanced features such as budgeting, forecasting, and compliance reporting, ERP Accounting Software can be customized to support the growth and complexity of a business.

Additionally, ERP Accounting Software enhances collaboration and communication within an organization by providing a centralized platform for various departments to access and share financial data. This helps in improving cross-functional coordination, increasing efficiency, and reducing errors caused by manual data entry or information silos.

Moreover, ERP Accounting Software offers a high level of data security and compliance with industry regulations. With built-in security features like user authentication, data encryption, and access controls, businesses can rest assured that their financial information is protected from unauthorized access or cyber threats. Furthermore, ERP Accounting Software helps companies to stay compliant with tax laws, accounting standards, and auditing requirements, thereby minimizing the risk of legal penalties or financial discrepancies.

In conclusion, ERP Accounting Software plays a vital role in helping businesses to manage their financial operations effectively and efficiently. By centralizing accounting processes, providing real-time insights, ensuring scalability and flexibility, enhancing collaboration, and maintaining data security, ERP Accounting Software empowers companies to make informed decisions, drive growth, and achieve long-term success in today’s competitive business landscape.

Benefits of Implementing ERP Accounting Software

Implementing ERP accounting software can provide numerous benefits to businesses of all sizes. Here are some of the key advantages of integrating ERP accounting software into your organization:

1. Improved Efficiency: One of the primary benefits of implementing ERP accounting software is the improvement in efficiency that it offers. By automating various accounting processes, businesses can streamline their operations and reduce manual errors. This can save time and resources, allowing employees to focus on more strategic tasks.

2. Enhanced Data Accuracy: With ERP accounting software, businesses can ensure greater accuracy in their financial data. The system stores all data in a centralized database, eliminating the need for manual data entry and reducing the risk of human error. This not only improves the reliability of financial reports but also helps businesses make more informed decisions based on accurate and up-to-date information.

3. Better Financial Reporting: ERP accounting software provides businesses with robust reporting capabilities, allowing them to generate various financial reports quickly and efficiently. These reports can provide valuable insights into the financial health of the organization, helping stakeholders make informed decisions and plan for the future.

4. Cost Savings: By automating processes and streamlining operations, ERP accounting software can help businesses save money in the long run. With reduced manual labor and improved efficiency, businesses can cut costs associated with data entry errors, redundant tasks, and unnecessary paperwork. Additionally, the improved accuracy of financial data can help businesses avoid costly mistakes and compliance issues.

5. Increased Productivity: With ERP accounting software handling routine accounting tasks, employees can focus on more value-added activities, such as financial analysis, budgeting, and forecasting. This can lead to increased productivity and innovation within the organization, driving growth and success.

6. Scalability: ERP accounting software is designed to grow with your business. Whether you are a small startup or a large enterprise, ERP systems can scale to meet your changing needs and accommodate business expansion. This scalability ensures that your accounting software can support your business growth without the need for costly upgrades or replacements.

7. Regulatory Compliance: Compliance with financial regulations and reporting requirements is crucial for businesses in today’s complex regulatory environment. ERP accounting software can help businesses stay compliant by automating compliance processes, generating accurate reports, and maintaining audit trails. This can help businesses avoid penalties, fines, and reputational damage resulting from non-compliance.

Overall, implementing ERP accounting software can provide businesses with a competitive edge by improving efficiency, accuracy, and productivity, while reducing costs and ensuring compliance. With the numerous benefits that ERP systems offer, businesses can streamline their financial operations and make better-informed decisions to drive growth and success.

Key Features to Look for in ERP Accounting Software

When considering ERP accounting software for your business, it is important to look for key features that will streamline your financial processes and improve overall efficiency. Below are some essential features to look for when selecting an ERP accounting software:

User-Friendly Interface

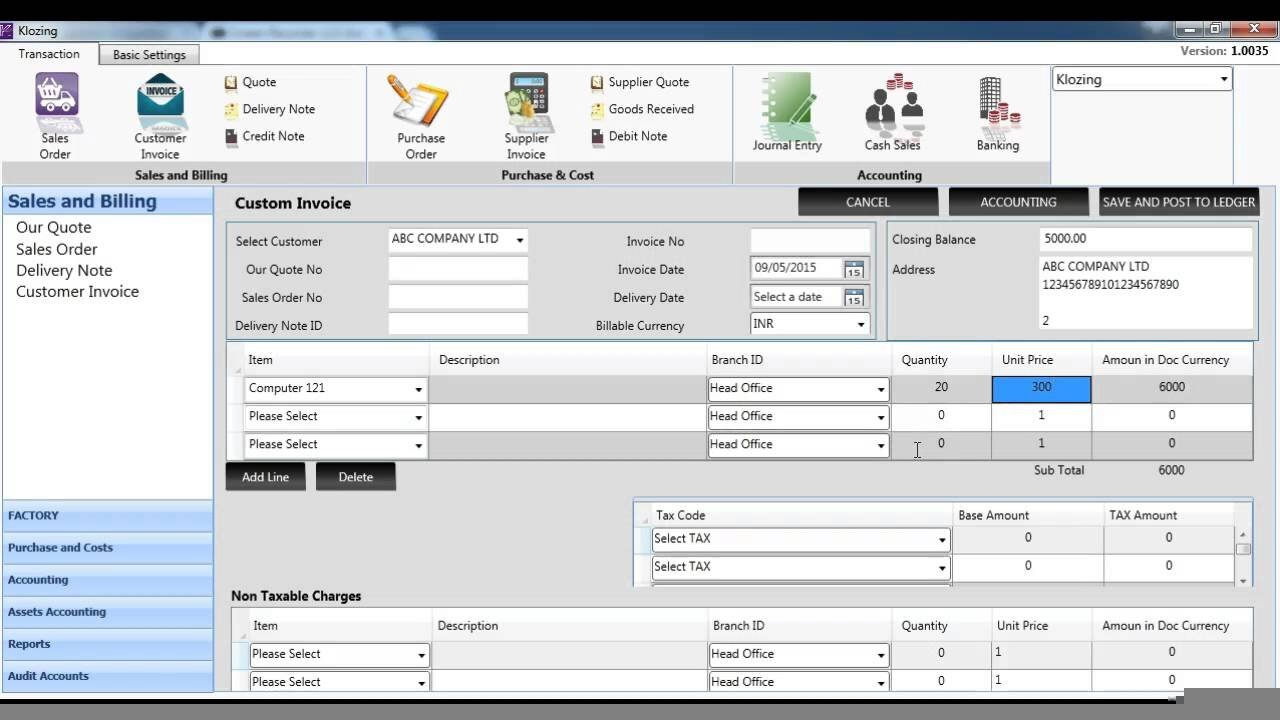

One of the most important features to consider when selecting ERP accounting software is a user-friendly interface. The software should be easy to navigate and understand, with intuitive features that minimize the learning curve for users. A user-friendly interface will help increase adoption rates within your organization and ensure that employees can quickly and efficiently complete their financial tasks.

Customizable Reporting Capabilities

Another key feature to look for in ERP accounting software is customizable reporting capabilities. The software should allow you to generate a wide variety of financial reports tailored to your specific needs. Whether you need detailed balance sheets, profit and loss statements, or cash flow reports, the software should offer customizable reporting tools that allow you to easily analyze your financial data and make informed business decisions.

Integration with Third-Party Applications

Integration with third-party applications is a crucial feature to consider when selecting ERP accounting software. The software should seamlessly integrate with other business tools and systems that your organization already uses, such as CRM software, inventory management systems, or payroll solutions. Integration with third-party applications will help streamline your financial processes and eliminate the need for manual data entry, reducing the risk of errors and improving overall efficiency.

Automated Workflows

Automated workflows are another essential feature to look for in ERP accounting software. The software should offer automation capabilities that allow you to streamline repetitive financial tasks, such as invoice processing, expense approvals, and reconciliation processes. By automating these workflows, you can save time and reduce the risk of errors, while also improving the overall accuracy and efficiency of your financial processes.

Scalability and Flexibility

Scalability and flexibility are key features to consider when selecting ERP accounting software. The software should be able to grow and adapt with your business, allowing you to easily add new users, modules, or features as your organization expands. Additionally, the software should be flexible enough to accommodate your specific business needs and requirements, allowing you to customize workflows, reports, and processes to fit your unique financial operations.

When choosing ERP accounting software for your business, be sure to prioritize features that will streamline your financial processes, improve efficiency, and support the overall growth and success of your organization. By selecting software with key features such as a user-friendly interface, customizable reporting capabilities, integration with third-party applications, automated workflows, and scalability and flexibility, you can ensure that your financial operations are streamlined and optimized for maximum effectiveness.

Top ERP Accounting Software Solutions in the Market

ERP (Enterprise Resource Planning) accounting software solutions are an essential tool for businesses of all sizes to efficiently manage their finances, streamline operations, and improve decision-making processes. With a wide range of ERP accounting software options available in the market, it can be overwhelming to choose the right one for your business. Here are the top ERP accounting software solutions that are highly recommended by users and experts:

1. NetSuite: NetSuite is a cloud-based ERP accounting software solution that offers comprehensive financial management capabilities, including financial planning, revenue recognition, and expense management. It also integrates with other business systems to provide a complete view of your financial data. NetSuite is known for its user-friendly interface and scalability, making it suitable for small to large businesses.

2. Sage Intacct: Sage Intacct is a popular ERP accounting software solution designed for growing businesses. It offers real-time visibility into financial performance, automated processes, and customizable reporting tools. Sage Intacct is known for its high level of automation, which helps businesses reduce manual errors and improve efficiency in their financial management processes.

3. QuickBooks Enterprise: QuickBooks Enterprise is a trusted ERP accounting software solution that is ideal for small to medium-sized businesses. It offers advanced features such as inventory management, payroll processing, and project costing. QuickBooks Enterprise is known for its ease of use and affordability, making it a popular choice among businesses that are looking for a reliable accounting solution.

4. Microsoft Dynamics 365 Business Central: Microsoft Dynamics 365 Business Central is an all-in-one ERP accounting software solution that integrates with other Microsoft applications, such as Office 365 and Power BI. It offers a wide range of financial management features, including general ledger, accounts payable, and accounts receivable. Microsoft Dynamics 365 Business Central is highly customizable, allowing businesses to tailor the software to their specific needs.

Overall, when choosing an ERP accounting software solution for your business, it is essential to consider factors such as your budget, business size, and specific accounting needs. The top ERP accounting software solutions mentioned above have received positive reviews for their functionality, ease of use, and ability to improve financial management processes. Take the time to evaluate each option carefully to determine which one aligns best with your business goals and objectives.

Steps to Successfully Implement ERP Accounting Software in Your Business

Implementing ERP accounting software in your business can be a game-changer in terms of efficiency and productivity. However, the process of implementation can be complex and challenging. Here are some steps to successfully implement ERP accounting software in your business:

1. Define Your Objectives

Before you start the implementation process, it is important to clearly define your objectives. What are the specific goals you want to achieve with the ERP accounting software? Whether it is streamlining processes, improving financial reporting, or increasing efficiency, having clear objectives will guide the implementation process.

2. Conduct a Needs Assessment

It is crucial to conduct a needs assessment to understand the specific requirements of your business. Take a close look at your current accounting processes, identify pain points, and determine what functionalities you need in the ERP accounting software to address those issues.

3. Choose the Right ERP Accounting Software

Once you have defined your objectives and conducted a needs assessment, it is time to choose the right ERP accounting software for your business. Consider factors such as scalability, compatibility with your existing systems, user-friendliness, and cost before making a decision.

4. Develop a Comprehensive Implementation Plan

Developing a comprehensive implementation plan is key to a successful ERP accounting software implementation. Outline the timeline, goals, responsibilities, and resources needed for the implementation process. Make sure to involve key stakeholders and communicate clearly throughout the process.

5. Provide Training and Support

One of the most crucial steps in successfully implementing ERP accounting software is providing adequate training and support to your employees. Many businesses overlook this step, leading to resistance and low adoption rates. Invest in training sessions, user manuals, and ongoing support to ensure that your employees are comfortable using the new software.

Training should be tailored to different departments and roles within your organization. Make sure that employees have a good understanding of how the software works and how it will benefit them in their day-to-day tasks. Encourage open communication and feedback to address any issues or concerns that may arise during the training process.

Additionally, providing ongoing support after the implementation is crucial. Have a dedicated support team available to address any technical issues, questions, or concerns that employees may have. Regularly check in with users to gather feedback and address any pain points that may arise. By providing adequate training and support, you can ensure a smooth transition to the new ERP accounting software.